« Familygreenberg.com Health Check – July Edition | Main | More Fakery in the Olympic Opening Ceremonies »

Calling Out Our Leaders on Oil & Gas

By Brian | August 11, 2008 | Share on Facebook

Oh, for a politician who understands the financial markets…

Oh, for a politician who understands the financial markets…

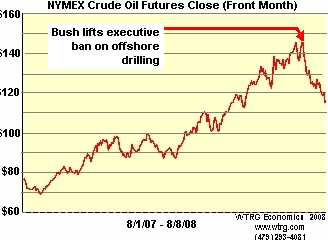

Back in mid-July, President Bush lifted an executive ban on offshore drilling

Topics: Money Talk, Political Rantings | 13 Comments »

My knowledge of the international oil markets is such that engaging you in a debate on this wouldn’t be even like bringing a knife to a gunfight; more like bringing a sharpened sponge. That said, I’ve read a number of articles recently that argue that the price of oil is not being particularly driven by speculation (cf. Slate, IIRC). I’ll admit that I have a bit of trouble with the idea that the value of this investment has dropped 20% based purely on a governmental action that the entire market knows to be meaningless, and I rather wonder what other factors might be influencing the drop. (For example, your graph shows a sharp dip in the weeks preceding the speech, so my first question is whether the drop stems from the speech, or whether the peak you comfortably point to is an anomalous rise in a preexisting market change.)

That said, my real argument with your post is your reduction of the entire debate to dollars and cents. Yes, some Democrats argue that we shouldn’t drill offshore because it won’t affect prices for years, but other Democrats argue that we shouldn’t drill offshore for a host of other reasons. The price of gasoline makes for a more conducive environment, so to speak, for these alternative reasons to be heard, but transmogrifying the entire argument into the current cost per gallon of liquified dead dinosaurs rather missed the point.

It does, however, frame the argument such that it’s easy to score points for the Bush administration over a tiny drop in an overall price rise over which he’s presided (and many would argue, caused), so bonus points for rhetoric.

Jeff:

1) Re: comment spam – I’ve become quite the target lately (my post on fake China fireworks attracted a 9/11 conspiracy theorist who I even considered not deleting, until his YouTube links went from 9/11 video to Chinese porn). These two were on the fence, so I left them in.

2) I don’t think the government’s action was meaningless, and the markets agree with me. Bush lifting the ban puts the U.S. a lot closer to offshore drilling than it was before, and speculators are in the business of managing risk (just like poker: if the turn gives you a draw, you’re more likely to bet on the river…).

3) It was not my intent to “score points” for the Bush administration here. Those who would claim that Bush brought oil prices down are as wrong as the “many” you cite in your comment that would claim that he caused the price rise. Oil prices spiked due to many factors, and they are fairly well known at this point: the weak dollar, the declining stock market, the bursting of the housing bubble, and the increased demand in East Asia. These factors drew speculator money to a market that didn’t typically attract it, and so now a change on government policy can move the market (by driving speculators elsewhere).

My point was regarding the presidential candidates, and how they and their minions made statements of certainty that have proved to be wrong within a matter of weeks (the kind of statements that you’ve often quoted back to me as “documented fact.”), and how neither candidate seems to possess the basic understanding of world markets to change his tune on the subject. Basically, I’m fine with you bringing a sharpened sponge to this arguemnt, but I’d like my president to at least know someone who owns a gun.

4) Believe it or not, we quite likely agree on the non-financial aspect of this discussion. Totally absent from this post is the discussion on whether we should encourage decreased oil prices, since the bubble conditions seemed to have been driving inovation in that “emergency mode” I discussed here, here and here. In that regard, I tend to think that high oil prices (and, to your point, high gas prices) is generally a good thing, given society’s response. Where you and I probably differ is that I can see an argument for gaining control of the supply ourselves, rather than allowing it to rest in the Middle East, and then allowing the market to chase the cheaper, longer-term solutions.

It’s funny, though. When you and I discussed this in the other posts I linked to above, you were dead set against these “adaptive” measures because they’d be too little, too late, while “preventative” measures could begin right away. If the graph above shows anything, it’s that “adaptive” measures certainly have a place at the table in this debate.

I don

The action in question requires a ten-year lead time for a result that should affect the market, so it seems to me that only 10-year futures and greater would be affected.

Markets work on risk, not results. When you say “the action in question requires a ten-year lead time for a result that should affect the market,” it suggests that you read somewhere that “it will take ten years for new oil to reach consumers” and decided (as the two candidates and scores of pundits have implicitly decided) that the markets will only move when new oil reaches the consumers. This was the point of my original post. Bush’s action was enough to move the markets. A lifting of the Congression ban would move them again, and the approval for additional onshore drilling would move them again. Investors don’t wait for the oil to arrive to decide that supply is going to increase. They look for signals, and then adjust the risk/reward equation appropriately.

Why did Bush’s action move the markets? Some traders may have seen it clearing a regulatory hurdle, others may have seen it as pressure on Pelosi/Reid to lift the Congressional ban, others may have simply been sitting on huge investment gains and jumped ship at the first sign of something that might lower prices, creating a self-fulfilling prophecy. Could the other factors that you mentioned move the markets too? Sure. Humans are, for the most part, irrational, but large groups of humans (i.e., markets) tend toward rationality. It’s like Wikipedia – not perfect, but trending that way.

I am absolutely frickin

FamilyGreenberg.Com is proudly powered by WordPress.

The template is from RFDN and has been modified extensively by yours truly

Here is the RSS feed for the Entries and here is the RSS feed for the Comments