« OK, who didn’t see THIS coming? | Main | Claiming my WordPress Blog on Technorati »

This is Up, This is Dow…

By Brian | October 14, 2008 | Share on Facebook

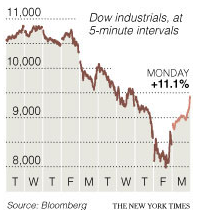

It’s not every day that the markets provide the financial media with the opportunity to use terms like Best Day Ever!, but that’s what happened yesterday and, if the futures market is any indication, today’s shaping up to be similar.

It’s not every day that the markets provide the financial media with the opportunity to use terms like Best Day Ever!, but that’s what happened yesterday and, if the futures market is any indication, today’s shaping up to be similar.

The reason? There were three: Hank Paulson announced yesterday that the U.S. Federal Government was going to make direct equity investments in the nation’s banks, the FDIC announced that it would insure all non-interest bearing bank accounts with no maximum dollar amount, and the Federal Reserve invoked Depression-era emergency powers that allow it to buy commercial paper, providing liquidity in a market that has seized up like an engine with a giant oil leak.

This is bad for a number of reasons and good for one reason, but the one reason it’s good trumps all the others, so I’m glad to see it happen.

It’s bad because it’s a step toward socialism. The federal government now has a significant, minority stake in our nation’s banks. And it is already using the power of that investment to tweak corporate policy – executive pay and severance packages (i.e., “golden parachutes”) are already restricted, and Senator Chuck Schumer (D-NY) is recommending that participating banks eliminate their dividends and “stick to safe and sustainable, rather than exotic, financial activities,” whatever that means.

It’s bad because despite all of these restrictions, it’s only semi-voluntary. From today’s New York Times:

Mr. Paulson outlined the plan to nine of the nation

Topics: Money Talk | 1 Comment »

One Response to “This is Up, This is Dow…”

It

FamilyGreenberg.Com is proudly powered by WordPress.

The template is from RFDN and has been modified extensively by yours truly

Here is the RSS feed for the Entries and here is the RSS feed for the Comments